A New Perspective on Real Estate in Thailand in the Post-Epidemic Era: Multi-Criteria Decision Analysis

Una nueva perspectiva del sector inmobiliario en Tailandia en la era posepidémica: análisis de decisiones con criterios múltiples

Fan Zhai*

Ahmad Yahya Dawod**

Somsak Chanaim***

Naret Suyaroj****

*Ph.D. in systems engineering. [1]. fzhaian18@gmail.com © https://orcid.org/0009-0003-1222-4458

**Ph.D. in information science and technology. [1]. ahDawodyah@outlook.com © https://orcid.org/0000-0002-1055-4037

*** Doctor of Philosophy. [1]. chaimaisak@hotmail.com © https://orcid.org/0009-0001-6138-9334

**** Ph.D. in Electrical Engineering. [1]. suyNararoj@outlook.com © https://orcid.org/0000-0003-3488-4943

[1] International College of Digital Innovation. Chiang Mai University. Chiang Mai, Thailand

How to Cite: Zhai, F., Dawod, A., Chanaim, S., & Suyaroj, N. (2024). A New Perspective on Real Estate in Thailand in the Post-Epidemic Era: Multi- Criteria Decision Analysis. Apuntes del Cenes, 43(78). Págs. 163-180. https://doi.org/10.19053/uptc.01203053.v43. n78.2024.17278

Reception date: March 1th, 2024 Approval date: June 19th, 2024

Abstract:

The objective of this study was to evaluate the impact of the pandemic on Thailand's real estate market and to propose recommendations for investors and other market participants on how to continue operating in the market. The primary research methods employed were analysis, forecasting, and abstraction. The impact of the global pandemic on Thailand and the country's economy, with a particular focus on the real estate sector, was evaluated. The changes observed in the real estate sector since the onset of the pandemic were presented, including a decline in activity due to travel restrictions, a correction of residential and commercial property prices, an increase in demand for suburban properties, and a shift towards online sales, among other notable developments.

Keywords: COVID-19, regional development, scenario analysis, investments, finances, Thailand.

JEL Classification: I15; F63; R58; R51; G01.

Resumen:

El propósito del estudio fue evaluar el impacto de la pandemia en el mercado inmobiliario de Tailandia y elaborar recomendaciones para los inversores y otros participantes en el mercado para poder seguir operando en este. Los principales métodos de investigación utilizados son el análisis, la previsión y la abstracción. Se estimaron los efectos de la crisis a causa del COVID-19 en Tailandia y en la economía del país, así como en el sector inmobiliario en particular. Se mostraron los cambios observados en el sector inmobiliario desde el inicio de la pandemia, como la disminución de la actividad debido a las restricciones de viaje, la corrección de los precios de los inmuebles residenciales y comerciales, el aumento de la demanda de inmuebles suburbanos y el desplazamiento hacia las ventas en línea, entre otros.

Palabras clave: COVID-19, desarrollo regional, análisis de escenarios, inversiones, finanzas, Tailandia.

INTRODUCTION

The real estate sector plays a pivotal role in the advancement of a country, exerting a profound influence on its economic, social, and infrastructural growth. For instance, the construction, sale, and maintenance of real estate result in the creation of a considerable number of jobs and contribute to the growth of gross domestic product (GDP). Furthermore, real estate ownership can serve as a source of income through the rental or sale of real estate. Real estate development also often leads to the expansion and improvement of infrastructure in urban and regional areas. The construction of new residential complexes, commercial premises and infrastructure improves roads, communications, energy supply and other vital systems, which has a qualitative impact on social conditions.

In addition, real estate frequently serves as the foundation for financial transactions, including loans, mortgages, and investments. In other words, real estate is one of the most significant sectors that numerous scholars consider when analyzing a country's economic situation.

The global impact of the COVID-19 pandemic has been profound, affecting nearly all industries, businesses, and individuals across the globe. The real estate construction and rental sector is similarly affected. Consequently, it remains pertinent to assess the state of the industry and provide guidance on the activities of companies within it. This study addresses these concerns. In particular, Thailand was the focus of attention, given the country's high dependence on foreign tourists and the emergence of trends such as population decline, which raise concerns about the long-term sustainability of the market in Thailand.

The country's path to economic recovery and development in the context of the COVID-19 crisis was studied by Benyaapikul (2021). The scientist noted that the country's development methods involved innovative development, a significant role of start-ups, and, as a result, frequent problems with a shortage of qualified personnel. Additionally, challenges were encountered in the field of education, which proved unable to educate the requisite number of workers in the allotted timeframe. Sampantamit et al. (2020) conducted a study on the country's environmental sustainability. The researchers highlighted the rapid development of the country in recent years, while also noting the emergence of problems in the context of the external environment. As a result, there is an urgent need to develop and implement effective management strategies to address these environmental issues, which also applies to the construction industry.

The impact of international labor migration on regional economic growth in Thailand has been studied by Tipayalai (2020), who points to some existing changes in migration patterns. The study suggests that Thailand should prioritize attracting highly skilled foreign workers by offering flexible entry rules, tax incentives and business opportunities, as well as new additional investments in infrastructure, research support and research institutes. The need for new staff is also evident in the construction industry. Phorncharoen (2020), in turn, assessed the impact of market orientation, as well as the development of innovation and training on the real estate market. She described the impact of these variables on the development of the real estate market, and what exactly it is. However, the researcher did not formulate any business advice for companies or government policy in this area. Rattanaprichavej (2021) examined how Thai real estate agencies have coped with challenging situations such as the COVID-19 pandemic. The study assessed the crisis management strategies employed by these agencies, with a particular focus on the unique characteristics of the Thai real estate industry, which is highly dependent on foreign demand.

The aim of this study is to assess the impact of the pandemic on the Thai real estate market and in particular on its investors and companies. This will allow for more effective decision-making in the face of a crisis in such a market, as well as a more effective response in the future in the event of a new similar situation.

MATERIALS AND METHODS

This paper describes a method called Multi-Criteria Analysis, which is a decision-making methodology designed to help managers evaluate and choose among multiple alternatives or options based on multiple criteria or objectives. In essence, it consists of several components, namely, selecting alternatives, selecting the criteria against which these options are evaluated, assigning a score to each option, aggregating the scores, and formulating a decision based on the analysis. The article details its features and shows how it can be used by real estate companies in Thailand.

A separate statistical database was used in the study. Thus, the study used data from the Numbeo website to analyse real estate price data in selected cities of Thailand, namely Chiang Mai, Bangkok, Samut Prakan, Udon Thani and Nonthaburi (Numbeo, 2023). Information from the Trading Economics website was also used to analyze the number of people living in Thailand and the trends observed in this area (Trading Economics, 2023). Inflation data was analyzed from the World Data website, which allowed us to see certain economic trends in the country over a fairly significant period of time (World Data, 2023). Information from certain sources of global organizations, namely the World Bank, was also used to assess the current economic situation of the country, along with the inflation index (World Bank, 2023). All calculations were performed in Microsoft Excel.

The approach used in the study was systematic. It allowed to evaluate the factors that influenced the development of the real estate market during the COVID-19 crisis, taking into account their development in the framework of interaction. This made it possible to better understand their nature and role in terms of their impact on the real estate market, and therefore to more accurately select the factors that have a real impact on the object of study. The main research method was analysis. It made it possible to use the available quantitative and qualitative data to draw important conclusions about the development of the real estate market in Thailand and its future trends. The historical method, in turn, allowed for an assessment of the phenomenon in question in the past, in retrospect, which made it possible to better understand the real reasons for the existence of certain phenomena today, and therefore to better analyze them. In addition, forecasting was used to assess future trends in the country's real estate market. Abstraction also helped in the selection of the main influencing factors, as it allowed the impact of each of them to be assessed individually and those that did not have sufficient influence on the real estate market to be rejected. Research methods related to statistical analysis of data were also used; the graphical method was used to display relevant data that characterized the state of real estate development in Thailand in one way or another. Statistical methods such as historical analysis, forecasting, and the graphical method were used to draw conclusions based on large data sets.

RESULTS

The global impact of the COVID-19 crisis on the property market has been comparable to that observed in other sectors. The market has undergone significant changes in the few years since the start of the pandemic. For instance, during the initial phase of the pandemic, there was a noticeable decline in real estate market activity due to travel restrictions and uncertainty about future prospects; many regions observed a slight correction in residential and commercial property prices due to reduced demand and economic instability. Additionally, the increased use of remote work led to an increase in demand for property in suburbs and remote regions. Furthermore, several obstacles were encountered in the process of securing financing for the purchase. These included more stringent lending criteria, a greater challenge in obtaining mortgage loans, more exacting credit score requirements, higher down payment requirements, and a reduction in loan approval rates. Investors in this sector have begun to pay more attention to market stability and opportunities for long-term investment. During the COVID-19 crisis, the market was dynamic, and the situation on it changed frequently and rapidly, which affected the state of the economy in general and people in particular, who were largely affected by changes in housing prices.

The impact of the COVID-19 pandemic on the Thai real estate market as a whole was also significant and noticiable. This was due to a decrease in demand from foreign buyers, as Thailand has always been a popular destination for foreign investors and property buyers. For instance, the demand from foreign investors dropped by 40% in 2020 compared to 2019 (Jiang, 2021). However, the pandemic has led to restrictions on international travel and a decline in the interest of investors from other countries. The hotel industry has also been affected by the decline in tourist arrivals, with occupancy rates falling by 75% at the peak of the pandemic (Khuntaweethep & Koowattanatianchai, 2022). During the pandemic, the demand for property types changed, which is generally a common trend across all countries. There was also a noticeable decline in property prices by approximately 15%, as well as a shift to online sales, which increased by 30% (Jiang, 2021). The latter was driven by new requirements for user security and the need to increase their own competitive advantage. Some components of this impact are similar to those in the rest of the world, while others are not, but they all change the rules for companies operating in the local Thai market. They should be taken into account when making management decisions and operating in the market in general. Thus, the approach of companies to their decision-making process in the context of market activities should also change. As part of this work, it should be proposed to use the method of multi-criteria decision analysis, which has already been mentioned in detail above.

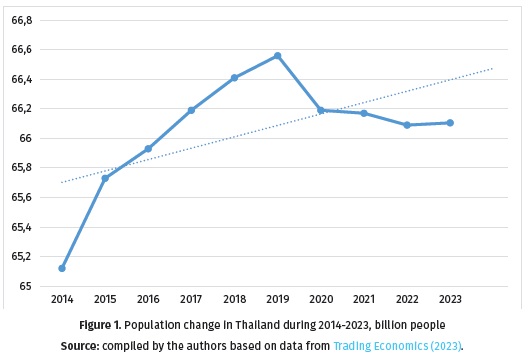

It is worth considering what changes have occurred in the real estate market in Thailand since the beginning of the pandemic, and certain data that may be related to the state of this market. For example, the population of the country correlates with the state of the market and its prices, as shown in Figure 1.

As shown in Figure 1, the population of Thailand is gradually increasing. Such a trend is positive for the development of the country's real estate market, given the growing demand for various buildings and structures. However, some problems began in 2020 (a gradual decline in the number of the population is observed), which is probably related to the crisis of COVID-19 and the first manifestations of trends regarding the ageing of the nation as a whole (Krulicky & Hromada, 2022; Marttunen et al., 2017; Zlaugotne et al., 2020). Therefore, given the changes in recent years and their likely continuation, there may be some concern about the state of the market. This is mainly due to the fact that the larger the population of the region, the more actively it will spend money on purchasing real estate. It is also worth considering certain trends related to economic well-being, which are shown in Figure 2.

As can be seen from Figure 2, the inflation rate in the country remains moderate and only in 2022, due to global destabilization associated with the beginning of a full-scale invasion of Russia into Ukraine, it rose to a value of 6%. Russia's attack has had far-reaching economic consequences around the world, contributing to financial market instability, supply chains disruptions, and higher energy prices. These effects have compounded the existing challenges in Thailand's economy. Negative indicators, however, can be seen in terms of GDP, which indicates a decrease in the rate of economic growth and existing problems with the creation of new types of products in the country, the possibilities of production of products and services (Kupriyanov, 2022). This also suggests that there are difficulties in the real estate market in the country, as its condition directly depends on the standard of living of the population. Thailand's economy has been significantly affected by the ongoing conflict between Israel and Hamas, especially in terms of exports to Israel. Additionally, the disruption of shipping routes through the Red Sea has resulted in higher transportation costs. In spite of these obstacles, the Thai government has taken action to lessen the effects, including working with shipping companies to modify freight rates and enacting gradual increases to help exporters better control costs. The situation in the real estate market can be understood in more detail by evaluating the data in Table 1.

As shown in Table 1, rental and purchase prices and mortgage rates can vary widely across the country. Companies that built or invest in real estate should also pay particular attention to this information, as it can directly affect their future cash flows. Various indicators that characterize the market should be considered separately, such as the rental price of different types of flats, including one-bedroom and three-bedroom flats, as well as the price per square meter depending on the location. It should also be noted that when making management decisions, it is not worth paying attention to regional averages, as they can vary significantly depending on where a particular property is planned to be built. For this purpose, it is worth conducting an independent assessment by experts hired by the company. It is also worth noting that when companies conduct their own assessments, they should identify a much larger number of criteria (both in the case of construction and investment processes). These may include the geographic location of the property, trends in local markets, the financial performance of each project, etc.

When operating in the real estate market in Thailand, companies can use the method of multi-criteria decision analysis. Its essence lies in the ability to assess the formation of decisions in various areas by evaluating scenarios and relevant criteria that will differ in each of the alternatives. A more detailed explanation of the multi-criteria decision analysis model can be seen in Figure 3.

As it can be seen from Figure 3, multi-criteria decision analysis can be divided into 5 main components. Thus, the evaluation process involves defining a set of alternatives or options to be assessed. These alternatives can be potential solutions to a problem, projects, products, or any other options that require a decision. The next step is to establish a list of criteria for selecting the alternatives. The criteria are factors or attributes that are relevant to the decision-making process and will be used to evaluate and compare the alternatives; they can also be qualitative or quantitative and should be carefully chosen to ensure that they are both representative of the research objectives and actually help in the decision-making process. Once the criteria are identified, the decision maker assigns weights to each criterion to indicate its relative importance or priority. These are based on expert judgement, so they may vary depending on who is doing the work. Most often, these weights are expressed as percentages. Each alternative from the criteria is then assigned a score: by multiplying these values, an overall assessment of a particular alternative (utility score) is formed. This overall score reflects the overall effectiveness or suitability of each alternative. The alternatives are then ranked based on their overall scores, with the highest scoring alternative being the preferred or recommended choice (Boanada-Fuchs & Fuchs, 2022; Jamwal et al., 2021). For better scoring and weighting, it is advisable to solicit the opinions of many experts and use the average of all of them to arrive at the most effective scores. In summary, multi-criteria decision analysis can provide a systematic and transparent framework for making complex decisions, allowing decision makers to consider multiple and qualitative criteria and their relative importance in formulating decisions, making them more informed and balanced.

Thus, a similar practice can be applied to Thailand and the real estate market. It provides a structured and systematic approach to decision-making, taking into account multiple criteria and their relative importance: this allows for more efficient decision-making than other methods, such as standard investment decision-making methods by discounting projected cash flows. This is because multi-criteria decision analysis allows you to evaluate not only financial or economic factors, but also other factors, even qualitative ones. For example, factors such as the rental price of flats of different sizes and the price per square meter were mentioned above: they should, of course, also be evaluated, but other qualities should also play a role, such as an assessment of the region in which the building is located, the likelihood of disasters in the area, etc. This can greatly assist in the acceptance of individual investment projects. This method is also flexible and adaptable to different contexts and scenarios, and can be applied in virtually any environment, even under complete uncertainty. Multi-criteria decision analysis can also be used for scenario analysis, i.e. to reduce the level of uncertainty in the market that arises during and after the pandemic. All the characteristics of this type of decision analysis described above can help overcome the challenges posed by the COVID-19 pandemic and make informed investment decisions in a volatile environment.

DISCUSSION

An investigation of Thailand's demographic dynamics provides significant insights into economic growth plans. Scientist Pattarakijkusol (2021) emphasizes the significant impact of population changes on economic trajectories. This approach underlines the combined effect of labor productivity and dependency ratios on economic outcomes. In particular, the study's findings illustrate the important and often surprising role that the dependency ratios of young and old play in economic success. This understanding is critical for developing real estate strategies in Thailand, where the balance of workforce availability and population pressures must influence investment decisions and policy formulation. As stated in the paper above, in the current environment, the country's population is declining significantly, which could have negative long-term social and economic consequences (Abdullah et al., 2021; Bas, 2022; Salman et al., 2019). They described the positive impact of institutional development on economic growth. They also pointed out the importance of ensuring that local institutions are in place to balance economic growth and environmental concerns, especially in the context of emerging economies in East Asia, such as Thailand. While this component is indeed important for the development of the country as a whole, and real estate in particular, scholars should also pay attention to other important components when formulating any advice on long-term economic growth, including the overall macroeconomic situation, political and social stability, etc.

Real estate construction has an important role in achieving economic and social sustainability, according to a study done by Strömbäck and Tärnell (2022). The researchers gathered information from numerous real estate enterprises in Sweden to better understand how these entities contribute to social sustainability and profitability. Their findings show that social sustainability is becoming more essential in the real estate industry, driven by the need for businesses to meet societal standards while also improving their market position. The study emphasizes that larger corporations are more likely to participate in social sustainability projects due to increased resources and demand. Furthermore, public-private partnerships are highlighted as an important strategy for dealing with market crises like the COVID-19 epidemic. These partnerships can help to implement sustainable practices and boost economic resilience. The authors also suggest that real estate development be closely linked to urban planning, with an emphasis on regulatory measures and the establishment of sustainable and efficient financial objectives.

Balemi et al. (2021) studied the impact of COVID-19 on real estate markets. They noted that it was multifaceted and could vary across sectors. The long-term consequences remained uncertain and depended on many factors, which complicated the scientists' analysis. The researchers noted that during the crisis, there was a shift to remote work, which led to a decrease in demand for office space. They predicted that coworking and shared offices could replace traditional office space, which would affect rental prices and profits for investors and companies. The pandemic has also accelerated the shift to online shopping, affecting traditional retail facilities. Since the crisis has led to changes in supply chains, they pointed to changes in the development of stores, including their transition to online format, the creation of their own pages on the network, etc. The researchers also wrote about the relatively minor impact on the real estate market but described significant problems with the ability of the population to repay mortgages. Similar negative effects were described in the paper above; in particular, the pandemic led to significant shocks at the outbreak, including in the real estate market, significant changes in real estate prices, etc. This led to market turbulence and negative effects on the social and economic spheres of the country. A study of the impact of the COVID-19 crisis as a clear example was conducted by Toro et al. (2021). The researchers described the impact of the pandemic on the real estate market in the Naples metropolitan area (Italy) and drew relevant conclusions in this regard. They noted that the COVID-19 pandemic has caused significant changes in real estate trends: demand for residential property has shifted towards larger homes with better natural light and amenities. In addition, the incorporation of technology into properties and their sales processes has become much more widespread. A significant number of sellers plan to use it even after the pandemic ends. This was due, among other things, to the spread of sustainable development narratives and the strengthening of the government's role in this context in terms of monitoring the environmental and social situation in the country. Due to the growing demand for certain types of buildings (although the demand for them has fallen overall), trends in the restoration of old facades and the adaptation of existing facilities, even relatively old ones that have been vacant for a long time, have become more common. As mentioned above, such changes have a significant impact on the market structure and may affect long-term development trends. Therefore, they should be assessed in detail when formulating investment strategies in the market.

Yeh et al. (2023) posit that multi-criteria decision-making (MCDM) models are already being utilized by countries such as Vietnam, Burma, and Cambodia to assess real estate investment projects. In making judgements about real estate investments in these developing Southeast Asian markets, decision-makers can consider a multitude of elements, including financial, environmental, and social aspects, due to the implementation of these MCDM models. The study's conclusions support the idea that MCDM is a useful method for assessing real estate ventures in Southeast Asian nations that are underrepresented.

As Chaiwuttisaka (2023) notes, the use of multi-criteria decision-making processes in Thailand's stock market serves to illustrate the country's advanced approach to investment strategy. The study conducted by the author employs the Analytic Hierarchy Process and the Technique for Order of Preference by Similarity to Ideal Solution to efficiently rank investment choices in the Energy and Utilities sectors of the SET50 index. This methodology not only allows for the comparative significance of many financial and technological standards to be measured, but it also aligns with the global trend of increasingly data-driven and analytical investment decision-making procedures. The integration of these approaches enables stock market stakeholders in Thailand to negotiate the intricacies of investment decisions with greater precision, which may ultimately lead to more robust investment outcomes. The real estate industry, among others, might benefit from this use of multi-criteria decision-making tools, as it requires a comparable level of analytical rigor to make the best possible investment decisions in the face of constantly changing market conditions.

In light of the aforementioned information, it is possible to offer certain recommendations for companies when utilizing the criterion analysis method. For example, it is prudent to adopt a comprehensive approach to data collection and the formulation of conclusions or judgements, as this can have a profound impact on the model, particularly in instances where numerical values are unavailable. It is recommended that all alternative scenarios be subjected to the collection of such information, with any necessary adjustments made. In addition, it is of the utmost importance to exercise caution when selecting criteria, especially those that are not directly related to the feasibility of the project. It is also essential to consider the importance of developing a sustainable business model that will be able to withstand a recurrence of a crisis such as the global pandemic of 2020. These considerations can significantly increase the performance of enterprises within the Thai internal real estate market.

CONCLUSIONS

The COVID-19 pandemic has had a significant impact on the Thai property market. Over the past few years, a number of notable shifts have been observed in the market, which are related to broader economic trends. These include a decline in population, a reduction in foreign investment, and a deceleration in GDP growth. Consequently, demographic trends, economic indicators, and disparate property prices within the country present a matter of concern that necessitates further investigation by academic researchers and by companies in their own decision-making processes. The variation in property prices, mortgage rates and rental rates that has been shown in the study by city in Thailand also highlights the importance of assessing regional specifics. It is recommended that companies conduct detailed assessments that take into account geographical nuances, local market trends and financial performance.

In this new environment, multi-criteria decision analysis is becoming a very effective tool. Its structure allows for a systematic evaluation of alternative solutions, including numerous criteria and their relative importance. By considering not only financial and economic factors, but also qualitative parameters such as location and disaster resistance, multi-criteria decision analysis enables decision makers to make informed and balanced choices. Furthermore, the adaptability of the method to different contexts and scenarios, including uncertainty, positions it as a robust strategy for addressing the challenges posed by the pandemic and its aftermath. Therefore, by using this methodology, companies operating in the Thai real estate sector can improve their decision-making processes, which will ultimately contribute to the sustainability and growth of the sector. Further research is needed to assess the state of the real estate market in other countries, as well as the performance of their companies during and in the aftermath of the pandemic. It is also important to identify strategies for leveraging this experience in Thailand.

ACKNOWLEDGMENT

The authors would like to express their gratitude to the editorial team of Apuntes del Cenes and the reviewers for their invaluable feedback and constructive suggestions, which have greatly improved the quality of this paper.

DECLARATION OF CONFLICTS OF INTEREST

The authors of this article declare that they have no conflicts of interest.

AUTHOR'S CONTRIBUTION

Fan Zhai was responsible for conceptualizing the research, visualizing the data, and drafting the original manuscript.

Ahmad Yahya Dawod was responsible for the curation and analysis of data, as well as the management of resources.

Somsak Chanaim developed the methodology, administered the project, and validated the results.

Naret Suyaroj supervised the process and conducted the investigations.

REFERENCES

[1] Abdullah, M. F., Siraj, S., & Hodgett, R. E. (2021). An Overview of Multi-Criteria Decision Analysis (MCDA) Application in Managing Water-Related Disaster Events: Analysing 20 Years of Literature for Flood and Drought Events. Water, 13(10), 1358. https://doi.org/10.3390/w13101358

[2] Balemi, N., Füss, R., & Weigand, A. (2021). COVID-19's Impact on Real Estate Markets: Review and Outlook. Financial Markets and Portfolio Management, 35(2), 495-513. https://doi.org/10.1007/s11408-021-00384-6

[3] Bas, M. (2022). The Impact of the COVID-19 Pandemic on the Residential Real Estate Market on the Example of Szczecin, Poland. Procedia Computer Science, 207, 2048-2058. https://doi.org/10.1016/j.procs.2022.09.264

[4] Benyaapikul, P. (2021). Thailand's Path to Economic Recovery and Advancement: Diagnostic Study on the Middle Income Trap and Prospects for Post-COVID Economic Growth. Thammasat Review of Economic and Social Policy, 7(2), 34-79.

[5] Boanada-Fuchs, A., & Fuchs, V.B. (2022). The Role of Real Estate Developers in Urban Development. Geoforum, 134, 173-177. https://doi.org/10.1016/j.geoforum.2022.05.009

[6] Chaiwuttisaka, P. (2023). Multi-Criteria Decision-Making for Investment Portfolio Selection in Thailand's Stock Market. In Proceedings of the Modern Management Based on Big Data IV (pp. 188-196). University of Huelva. https://doi.org/10.3233/FAIA230184

[7] Jamwal, A., Agrawal, R., Sharma, M., & Kumar, V. (2021). Review on Multi-Criteria Decision Analysis in Sustainable Manufacturing Decision Making. International Journal of Sustainable Engineering, 14(3), 202-225. https://doi.org/10.1080/19397038.2020.1866708

[8] Jiang, W. (2021). Impact of Covid-19 on the US Real Estate. In Proceedings of the 2021 International Conference on Enterprise Management and Economic Development (ICEMED 2021) (pp. 65-69). Atlantis Press. https://doi.org/10.2991/aebmr.k.210601.011

[9] Khuntaweethep, W., & Koowattanatianchai, N. (2022). Comparison of the Performance of Macroeconomic Finance Models for Financial Planning (MFM-FP) and ARIMA-Common Size in Forecasting ROE of Real Estate Developers in the Stock Exchange of Thailand. ABAC Journal, 42(4), 14-29.

[10] Krulicky, T., & Hromada, T. (2022). Impact of the COVID-19 Pandemic on the Real Estate Market in the Czech Republic. AIP Conference Proceedings, 2574(1), 120002. https://doi.org/10.1063/5.0105912

[11] Kupriyanov, D. (2022). International Cooperation Between Thailand and Democratic Kampuchea. Foreign Affairs, 32(2), 25-35. https://doi.org/10.46493/2663-2675.32(2).2022.25-35x

[12] Marttunen, M., Lienert, J., & Belton, V. (2017). Structuring Problems for Multi-Criteria Decision Analysis in Practice: A Literature Review of Method Combinations. European Journal of Operational Research, 263(1), 1-17. https://doi.org/10.1016/j.ejor.2017.04.041

[13] Numbeo. (2023). https://www.numbeo.com/property-investment/compare_cities.jsp?country1=Thailand&country2=Thailand&city1=Nonthaburi&city2=Chiang+Mai&tracking=getDispatchComparison

[14] Pattarakijkusol, S. (2021). The Effect of Population Structure on Economic Development: Thailand's Provincial Panel Data. [Thesis], Chulalongkorn University. https://digital.car.chula.ac.th/chulaetd/4871

[15] Phorncharoen, I. (2020). Influence of Market Orientation, Learning Orientation, and Innovativeness on Operational Performance of Real Estate Business. International Journal of Engineering Business Management, 12. https://doi.org/10.1177/1847979020952672

[16] Rattanaprichavej, N. (2021). Impact of COVID-19 Pandemic and Crisis Management Strategies on Real Estate Agencies. Contemporary Management Research, 17(4), 303-332. https://doi.org/10.7903/cmr.21349

[17] Salman, M., Long, X., Dauda, L., & Mensah, C. N. (2019). The Impact of Institutional Quality on Economic Growth and Carbon Emissions: Evidence from Indonesia, South Korea and Thailand. Journal of Cleaner Production, 241, 118331. https://doi.org/10.1016/j.jclepro.2019.118331

[18] Sampantamit, T., Ho, L., Lachat, C., Sutummawong, N., Sorgeloos, P., & Goethals, P. (2020). Aquaculture Production and Its Environmental Sustainability in Thailand: Challenges and Potential Solutions. Sustainability, 12(5), 2010. https://doi.org/10.3390/su12052010

[19] Strömbäck, A., & Tärnell, E. (2022). Evaluation and Learning about Social Sustainability in the Real Estate Industry. KTH Royal Institute of Technology.

[20] Tipayalai, K. (2020). Impact of International Labor Migration on Regional Economic Growth in Thailand. Journal of Economic Structures, 9, 15. https://doi.org/10.1186/s40008-020-00192-7

[21] Toro, P. D., Nocca, F., & Buglione, F. (2021). Real Estate Market Responses to the COVID-19 Crisis: Which Prospects for the Metropolitan Area of Naples (Italy)? Urban science, 5(1), 23. https://doi.org/10.3390/urbansci5010023

[22] Trading Economics. (2023). Thailand Population. https://tradingeconomics.com/thailand/population

[23] World Bank. (2023). GDP (current US$)-Thailand. https://data.worldbank.org/indicator/NY.GDP.MKTP.CD?locations=TH

[24] World Data. (2023). https://www.worlddata.info/asia/thailand/inflation-rates.php

[25] Yeh, W.W.K., Hao, G., & Ozer, M. (2023). Real Estate Investment Decisions in Underrepresented Southeast Asian Countries: Evidence from Cambodia, Myanmar, and Vietnam. Journal of Asia Business Studies, 17(6), 1143-1166. https://doi.org/10.1108/JABS-06-2022-0202

[26] Zlaugotne, B., Zihare, L., Balode, L., Kalbalkite, A., Khanbalkite, A., Khabdulkte, A., Khabdullin, A., & Blumberga, D. (2020). Multi-Criteria Decision Analysis Methods Comparison. Environmental and Climate Technologies, 24(1), 454-471. https://doi.org/10.2478/rtuect-2020-0028